Randian talks to Anders Petterson of ArtTactic on the latest version of the Chinese Contemporary Art Market Survey.

Anders Petterson grew up in Norway. Following a degree in management at the London School of Economics, he began a career as a capital markets analyst with JP Morgan in London. Petterson founded ArtTactic in 2001, bringing many of the research and analytical methods used in the finance world into the art market for the first time. Since 2007, ArtTactic has prepared annual and now biannual reports on the Chinese art market. The latest version of the Chinese Contemporary Art Market Survey has just been published.

Here Petterson gives an introduction to the survey and current trends.

(ArtTactic sponsors the Art Market section of randian 燃点)

Randian : What is the survey’s objective?

Anders Petterson: When we started with our first confidence survey of the US and European contemporary art market in May 2005, the objective was to capture a new type of data about the art market. Up until then, auction data was the only data that was available about the sentiment or the “state of the art market.” We wanted to develop a forward-looking tool, as our clients kept asking us about what was going to happen next. The survey’s objective is to capture the sentiment of a smaller number of market experts — we call them “insiders” — to assess how they feel about the overall art market, the risks and opportunities as well as the market for individual artists in the next six months. We have also developed a longevity — or survival indicator — which looks at the perception about the long-term sustainability of an artist’s market. For this particular question we ask the experts about the likelihood that the artist will remain of high importance in ten years time, and it forces the expert to look beyond the short term, and consider the factors that would make this true or not.

Randian: What does the survey offer serious collectors that they would otherwise not have access to?

中国艺术家,不同的市场(点击放大图片)

AP: Serious collectors would have a very good feeling of the sentiment in the market for individual artists. However, the survey allows these collectors to benchmark themselves against the sentiment or opinions of a larger number of other market experts and to monitor when significant changes in the sentiment take place. The survey is not there to replace existing research or information used by collectors, but is an additional set of structured information around the psychology or behavioral aspect of the market.

Randian : Who participates in the survey?

AP: In the last survey we had a sample of 73 key international and Chinese collectors, curators, auction houses, dealers, and art advisors. While the first confidence survey, launched in 2009, was largely a non-Mainland Chinese sample, the Mainland sample now accounts for about 30 percent. This is an aspect of the survey we are currently working on — as we need to increase the proportion of Mainland art collectors and buyers to reflect their increasing presence in the Chinese contemporary art market.

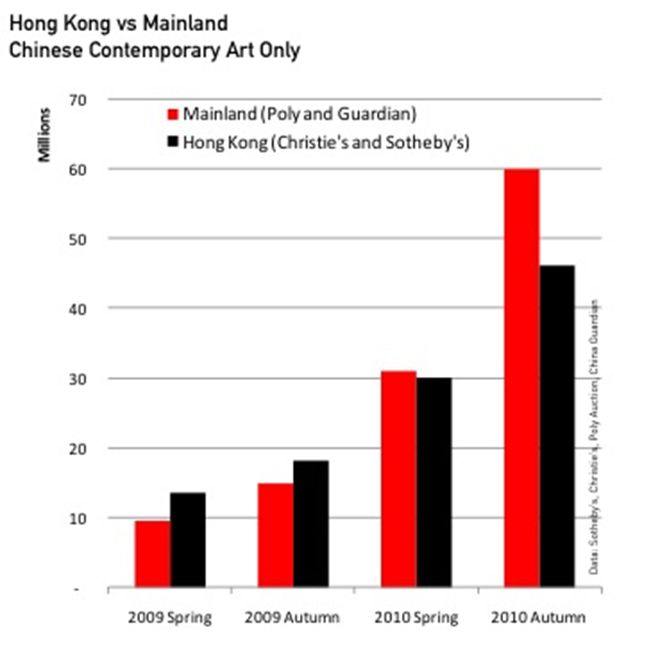

香港与中国大陆(点击放大图片)

Randian: How accurate is the survey?

AP: It’s difficult to say, as the confidence indicator is yet to be tested. It was launched in 2009, at a low level, and has since increased in line with the market. The recent indicator results in November suggested a market where the growth in confidence is flattening out. This corresponds to the recent auction results, which were solid, but not as strong as the spring results this year. We have to bear in mind that the survey results are not one-for-one comparable with what is happening in the actual Chinese contemporary art market. What we are interested in, is to spot when sudden directional changes are taking place — which is the equivalent of sentiment changes among the experts. For example, our US and European confidence index saw a significant negative drop in November 2007, about 10 months prior to the actual collapse of the market. At the time a significant number of the experts felt that the market was unsustainable in a deteriorating economic environment. However, those art markets did continue their positive runs until September 2008. The lag effect we experience between the indicator and the real events is largely because of the momentum in the market and the herd effect that the art market sometimes suffers from.

Randian : What major trends have you observed since the last survey?

AP: The increase in the confidence indicator has flattened out, which suggests that although confidence remains high (indicator at 80), we are likely to see a consolidation around current levels. The ArtTactic expectation indicator (measuring the market sentiment in the next six months) comes in at nine percent below the current indicator (measuring the market sentiment now versus six months ago). The speculation barometer for the Mainland Chinese art market remains high, which signals that a bubble could be building up in certain segments of the market.

Randian: Which artists have shown the most consistency since the surveys began?

AP: Ai Weiwei, Cai Guoqiang, Zeng Fanzhi, Yang Fudong, and Xu Bing are the artists that have been consistently in the top ten since the launch of the survey in February 2009.

Randian: Who are the movers in the new survey?

AP: Song Dong, Li Songsong, and Zhang Peili have seen the strongest positive movement in the last six months. Song Dong’s solo show at the Ullens Center (Ullens Center for Contemporary Art) in Beijing this year and his “para-pavilion” at the Venice Biennale this year have clearly increased the attention around the artist. Li Songsong has also experienced a significant increase in confidence. His latest solo show at Pace Gallery in New York was well received, and four out of his top five auction prices were achieved in 2011.

Randian: You regularly visit China — what do see as the most positive trends in the development of the art market?

以拍卖价格排名(点击放大图片)

AP: The growing interest in contemporary art among Mainland buyers is on the increase. The growing investment in art infrastructure, such as galleries and museums, will further raise the public’s interest in contemporary art. The recent announcement of the Chinese government’s strong focus on cultural investment will undoubtedly have an impact on the Chinese art market and its institutions.

Randian: And what are the risks?

AP: Speculation and buyers with a very short-term investment horizon could destabilize the market. The market lacks diversity — there is too much focus on the auction market. And the financially engineered art market needs regulatory guidance and legal frameworks. The recent surge in “art exchanges” is an example of this.

Randian: What is your perspective on the world art market in the next six months, and the China market particularly?

AP: I think the world markets will start to feel the impact of the economic crisis in the first half of next year. There will still be a market for rare, quality art at the very top end ($1 million and above), but the middle-market is likely to soften. We expect China to hold up better than its Western counterparts in the next months, but we are concerned about the short-term, speculative money that has found its way into the market. Many of these short-term investors could quickly turn into sellers if they see a sign of market weakness. This could be triggered by slower economic growth in China or by a reversal in the strong auction growth we have seen since 2009 — something that seems to already be happening. The Hong Kong auctions this autumn came in below expectations. Christie’s contemporary sales in Hong Kong came in 17 percent below the low estimate and the bought-in rates increased to 29 percent. Sotheby’s did better in October, primarily supported by the second part of the Ullens sale. However, the overall contemporary auction sales volume is down 36 percent from spring 2011.

The confidence indicator tells us that the market is taking a breather. But, as this is the first time the market shows signs of slowing down since 2008, one would hope that the market doesn’t panic.

Copies of the report may be purchased for GBP £75 from www.arttactic.com. ArtTactic Market Monitor is a premium online subscription service, which gives you full access to all of ArtTactic’s research reports, including Art Market Confidence Reports, Design and Photography Market Reports, Artist Reports, Auction Analysis, and country-specific reports. Subscription is annual GBP £395 or monthly GBP £35.